THE UK construction industry is facing a gloomy outlook for 2024, despite tentative signs that the economy is improving.

Inflation is still above the Bank of England’s target and so, for the time being, we don’t expect the Monetary Policy Committee to vote for lower rates. This is making mortgages expensive and pushing up costs for new construction projects, serving to both deter people from buying houses because of affordability constraints and to discourage companies from borrowing to build, causing both residential and non-residential construction projects to slow (although the market for repair and maintenance is performing well).

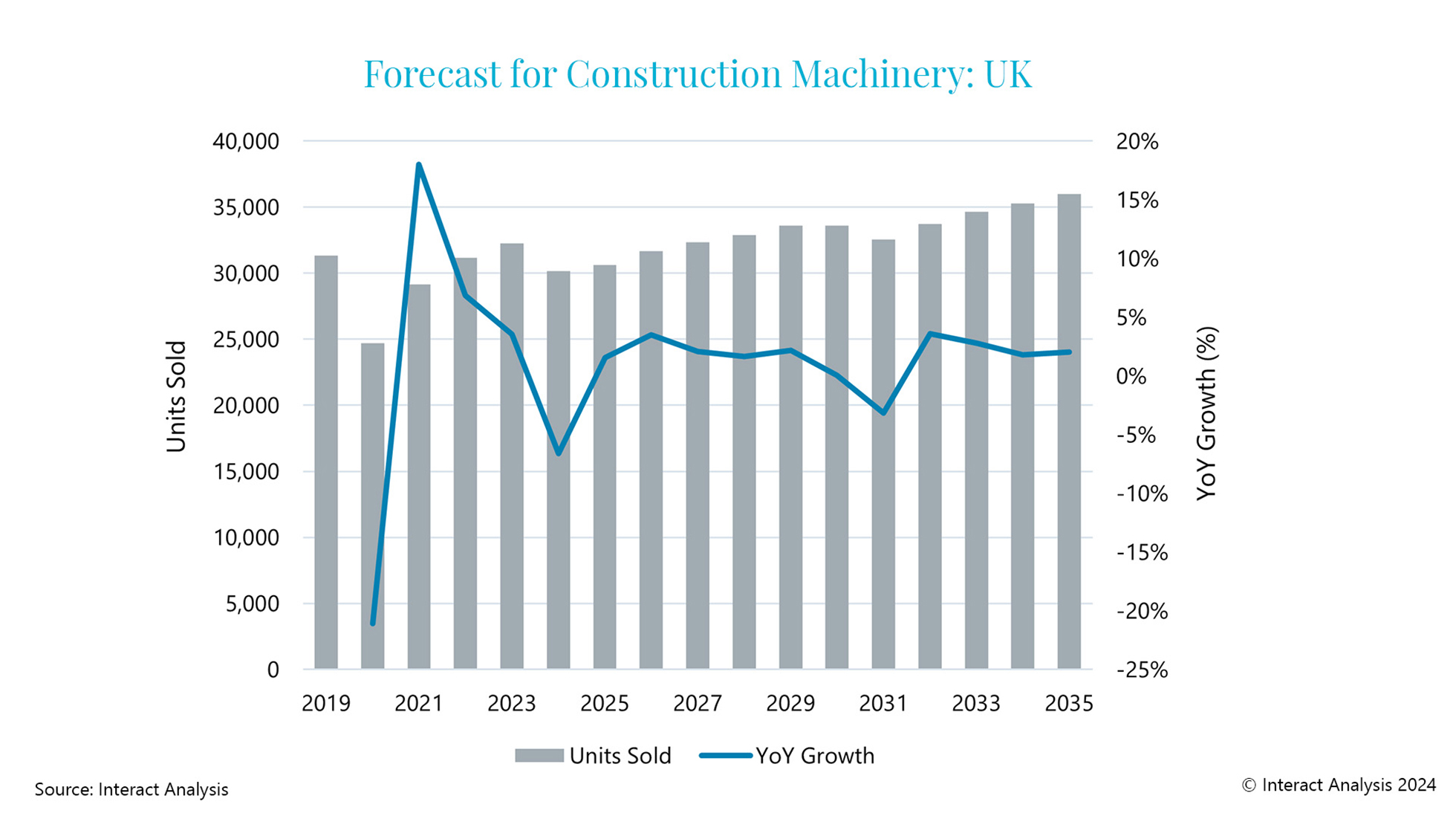

This slump in building is having a knock-on negative impact on sales of construction vehicles and we don’t foresee sales picking up until overall economic conditions improve enough to fuel new investment in construction, with activity potentially increasing by the end of this year.

The UK Economy

- The UK’s Gross Domestic Product (GDP) grew by 0.6% in Q1 2024 versus the previous quarter. This was largely attributed to falling inflation rates and means more disposable income per person on average.

- The Consumer Price Index including owner occupiers’ housing costs (CPIH) for the 12-month period up to April 2024 increased by 3.0% year-on-year, representing a 0.8% decrease compared with the value in March 2024. However, the CPIH annual rate for services remained at 6.0%. With much of the UK’s economy based on financial and retail services, prices are still going up compared with last year.

- It is for this reason that the Bank Rate, currently sitting at 5.25%, won’t be cut anytime soon, and maybe not until later in the year. The Bank of England’s priority is to get inflation under control, and ideally as close as possible to the 2% target figure.

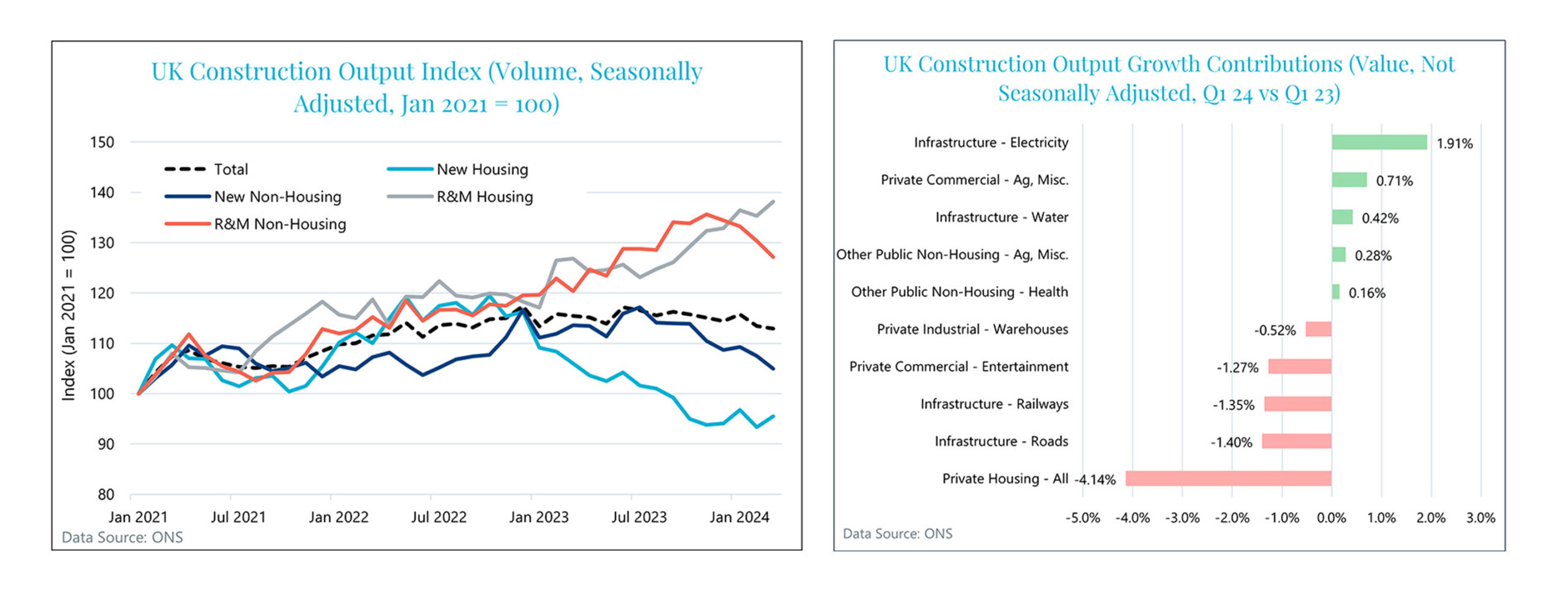

For the month of March 2024, UK Construction Output was valued at £15.16 billion – this was a 0.4% decrease compared with February 2024 and a 2.2% decrease compared with March of the previous year (adjusting for seasonality and price changes). In five of the past six months, construction output has decreased compared with the previous month, which paints a fairly gloomy picture.

Segmenting construction by work type (either new work or repair & maintenance) and by building type (either housing or non-housing), it can be seen in the chart below that repair & maintenance (R&M) is performing better than new work, with year-on-year growth rates of +7.3% and -8.5% respectively. In terms of housing, new housing output is down 10% year-on-year, however it is up 2.3% month-on-month. It’s likely that increased rainfall over the past couple of months is partly to blame for the fall in output.

R&M doing well doesn’t really have much of an impact on the construction equipment market – it’s newly started projects (especially housing) that require purchase or rental of equipment like excavators and other big clearing equipment. Work started on new houses in the UK fell by over 40% in Q4 2023 vs Q4 2022, from 39,040 to 23,360 houses. Looking ahead, new orders (i.e. planned projects) output grew by 16% in Q1 2024 versus Q4 2023, consisting of a decrease of 4.5% in new housing, and a 25% increase in other new work. However, as new housing is the main driving force behind the construction equipment market, 2024 is likely to see fewer sales compared with 2023.

Examining which industries have had the greatest contribution to the overall growth, it can be seen from the chart that, when comparing Q1 2024 with Q1 2023, electricity infrastructure had the greatest positive contribution (+1.91%), while private housing had the highest negative contribution (-4.14%). Other industries also seeing a decline in activity include infrastructure for roads (-1.40%) and railways (-1.35%). To increase sales performance this year, construction equipment rental companies may want to consider getting more involved in the better-performing industries, while limiting exposure to private housing and other poorly performing areas.

Right graph: Electricity infrastructure tops growth contribution; private housing worst off. Data source: ONS

Construction Materials

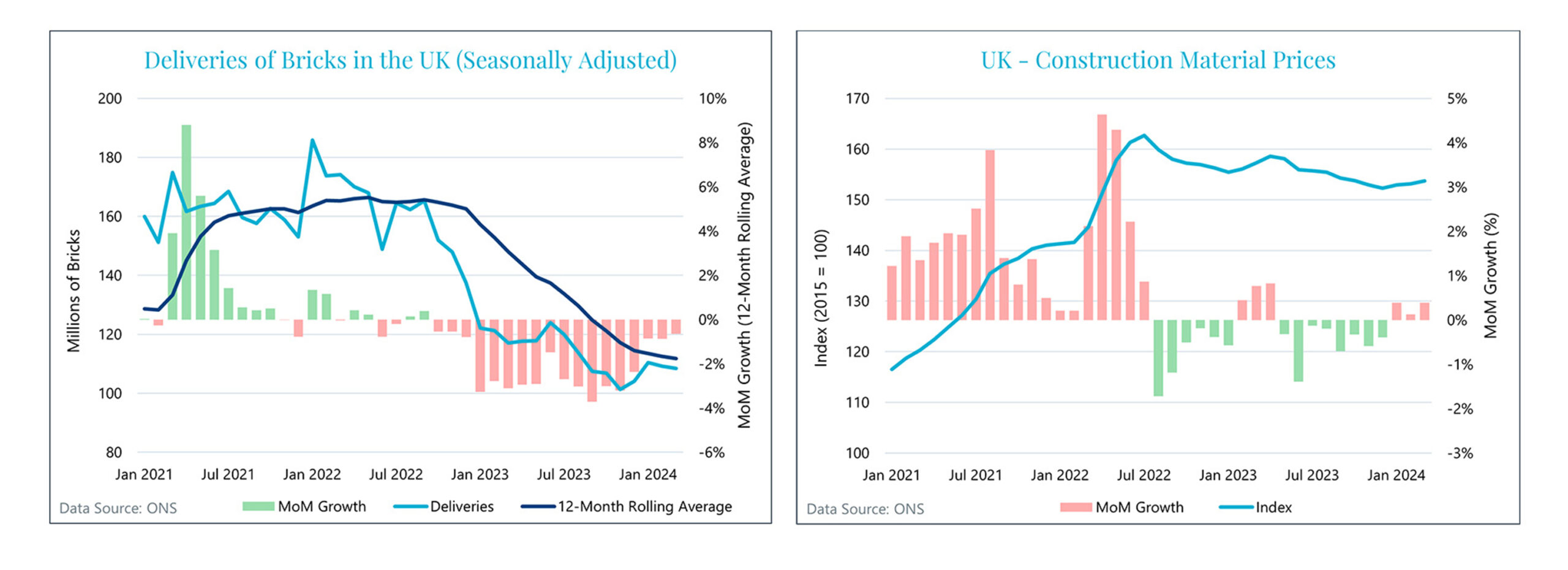

Monthly deliveries of bricks data can be a useful leading indicator for the number of new houses planned to be built. Looking at the 12-month rolling average, month-on-month deliveries have decreased every month from October 2022 to March 2024 – that’s a year and a half of consecutive decline! It’s a similar story for other building materials like sand and gravel. However, the 12-month rolling average seems to suggest that brick deliveries may be starting to bottom-out. Assuming further reductions to inflation, and subsequent moves to decrease interest rates, there is a chance that house building activity may start to pick up again by the end of the year.

Like most things, construction materials have seen their fair share of price increases. Looking at the construction material price index for all types of work, there have been consecutive increases for the past three months – with prices increasing by 0.9% from December 2023 to March 2024. Prices are slightly lower now than they were at their peak in July 2022, although still considerably higher than pre-pandemic levels.

High material prices are another dampener on the construction industry, as they impact margins and the general health of businesses’ cash flows. It is one of the main reasons behind the increased insolvency rates affecting the construction industry. In March 2024, 310 construction businesses became insolvent, while in the 12-month period leading up to March 2024, this figure was 4,274 – the highest of any of the major industries in the UK. Other reasons for these startling figures include persistent labour shortages and companies taking on more business that they can handle (or are equipped to handle), leading to eventual loss of contracts. To survive in this market, operators must make choices about where to deploy capital, and may decide to hold off purchasing/renting new machinery to combat other ongoing pressures. Alternatively, operators may decide to switch from their preferred brands and purchase cheaper equipment, shifting the dynamic of the market.

Right graph: Material prices remain high compared to pre-pandemic levels. Data source: ONS

Impact on the Construction Machinery Market

So what does this all mean for the UK construction equipment market?

Finning, a major supplier of construction equipment to rental companies and big contractors, announced a Q1 year-on-year net revenue increase of 3% in the UK and Ireland. This was driven primarily by used equipment sales (which nearly doubled), while new equipment sales remained level. It’s likely that affordability is the main reason for contractors turning to used rather than new machines. Finning’s product support revenue was down by 7% over the quarter, due to a combination of lower customer activity levels and reduced machine utilization hours. If activity is down, contractors aren’t going to buy new machines, especially if existing equipment isn’t being used to its full potential.

Ashtead Group, a large equipment rental company, had a rental-only revenue increase of 9% in the UK, of which 7% was organic. This was driven by both increased rental prices and higher sales volume, allowing the company to gain market share. When the economy is tough, companies prefer to rent/lease construction equipment rather than purchase, and if they do need to purchase used machinery costs less than new equipment.

A generally tough 2024 for the construction industry will negatively impact the number of construction vehicles sold. According to the latest edition of Interact Analysis’s Off-Highway Vehicles Market Study, the construction machinery market (in unit terms) is expected to fall by 6.6% in 2024 versus 2023, with just over 30,100 vehicles forecast to be sold (see chart below). This includes vehicle categories such as bulldozers, excavators and loaders. Beyond 2024, we anticipate a small improvement in sales, with 30,600 units projected to be sold in 2025 – a year-on-year increase of 1.6%. However, we’re not expecting sales of construction machinery to match 2023 levels until at least 2027; although 2023 was an artificially high year due to a rebound from the Covid-19 pandemic.

Current polls suggest that Labour will win the next election, which will take place on July 4 this year. The party’s manifesto commitment to boost house building could drive equipment sales in the future. However, it will take some time (possibly many years) before these plans are fully realized. Another (albeit unlikely) area where the UK could boost its construction industry is by backing construction of semiconductor manufacturing facilities in order to become more self-sufficient in this industry sector (similar to what’s happening in the US). However, the amount of investment and materials required would be substantial, making this unlikely.